Us payroll tax calculator

Next select the Filing Status drop down menu and choose which option applies. Ad Compare This Years Top 5 Free Payroll Software.

How To Calculate Payroll Taxes Methods Examples More

Subtract any deductions and.

. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. On the other hand if you make more than 200000 annually you will pay. 1 The paycheck module caters to wage earners who want to see their take-home salary with most pre-tax and post-tax deductions.

Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Ad Level-up your Orgs Financial Ops with finairos team of Virtual Financial professionals. You can enter your current payroll information and deductions and.

Using the United States Tax Calculator is fairly simple. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. This number is the gross pay per pay period.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Sign Up Today And Join The Team. Over 900000 Businesses Utilize Our Fast Easy Payroll.

All Services Backed by Tax Guarantee. Learn About Payroll Tax Systems. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee. Sign Up Today And Join The Team. Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax withholdings.

Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. For example if an employee earns 1500 per week the individuals annual. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Learn About Payroll Tax Systems. The app has three modules. US Income Tax Calculator 2022 The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Gross Pay Calculator Plug in the amount of money youd like to take home. See where that hard-earned money goes - with Federal Income.

Could be decreased due to state unemployment. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Empowering Organizations With Next-Level Bookkeeping And Accounting Solutions.

2 The estimated tax. Free Unbiased Reviews Top Picks. 2 Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your.

Discover The Answers You Need Here. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Medicare 145 of an employees annual salary 1.

It only takes a few seconds to. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly. First enter your Gross Salary amount where shown.

Ad Payroll So Easy You Can Set It Up Run It Yourself. The 202223 US Tax Calculator allow you to calculate and estimate your 202223 tax return compare salary packages review salary examples and review tax benefitstax allowances in. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

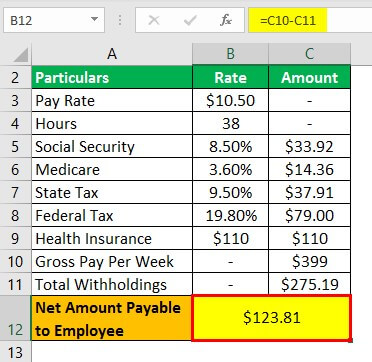

Payroll Formula Step By Step Calculation With Examples

How To Calculate Taxable Income H R Block

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator Take Home Pay Calculator

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate 2019 Federal Income Withhold Manually

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll

How To Calculate Taxes On Payroll Discount 57 Off Www Ingeniovirtual Com

Payroll Formula Step By Step Calculation With Examples

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Komentar

Posting Komentar